Explanation

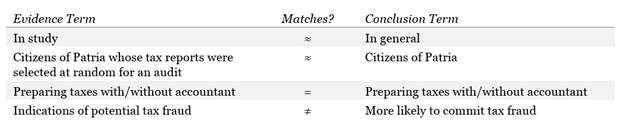

Reading the question: we're given an argument to pick

apart. Term matching is a good candidate for any argument, but especially

pseudo-syllogistic arguments such as this one, so we can create our filter by

looking for a mismatch of terms:

Creating a filter: the first two

rows highlight the same basic point, which is that, if the study has been

conducted in a way such that it is not representative of the population of

Patria as a whole, then the audit would be questionable. However, we've been

told that the citizens selected for the audit were selected "at random," so

they are most likely representative of the population. The most basic mismatch

is the final one: the term in the conclusion "more likely to commit tax fraud"

matches up imprecisely with the concept in the evidence "indications of

potential tax fraud." For example, maybe it's typical to demonstrate

indications of tax fraud and not commit fraud; maybe the indications are poor

predictors overall of whether these people are actually committing the tax fraud more. There's our filter.

Applying the filter: we look for an answer choice that

expresses this connection and find (B).

Logical proof: we can use the negation test to see whether

(B) is critical to the argument. What if citizens whose records have

indications of potential tax fraud are not

at all more likely to commit tax fraud? Indeed, then the argument

collapses, the higher incidence of these indications then would not constitute

evidence of a higher rate of tax fraud in any group. The correct answer is (B).

If you believe you have found an error in this question or explanation, please contact us and include the question title or URL in your message.