Explanation

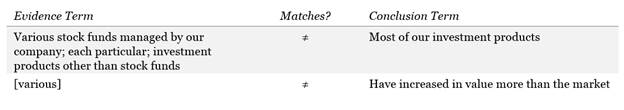

Reading the question: the fund manager's argument has many

error-prone features. It draws conclusions from a group of things, it deals in

percentages, and it makes comparisons. We will use term matching to hunt for an

error, starting with the conclusion.

Creating a filter: each half of the conclusion is

connected in multiple dubious ways to the evidence. The right answer will

probably involve a bad bridge from the evidence to one or to the other. For

example, the evidence is saying stock funds have beat the market "on average."

But that is not the same as saying that "most of our investment products" have

beat the market. Most could, in fact, be failures, with one anomalous market

saving the average. The second sentence doesn't help this problem. So we'll

paraphrase this error as "average <> most" and use that as our filter.

Applying the filter: (D) matches our filter precisely.

Choice (A) is not really an error, given the second sentence of the prompt.

(B), similarly, describes something the argument doesn't do. (C) is similar to

(D)--but who knows what the probability really is? It's not necessarily high.

(E) is similar to (D)--but pointing out that "any one" product might have done

poorly doesn't actually undermine the argument much, because it still allows

for "most of our investment products" to beat the market. The correct answer is

(D).

If you believe you have found an error in this question or explanation, please contact us and include the question title or URL in your message.